The Basics of Installment Loans

Installment loans are a sort of borrowing where the borrower receives a lump sum of money upfront and agrees to pay it again in fixed installments over a.

The Basics of Installment Loans

Installment loans are a sort of borrowing where the borrower receives a lump sum of money upfront and agrees to pay it again in fixed installments over a predetermined interval. This structure appeals to many as a outcome of it offers predictable monthly funds and clear compensation terms. Typically, these loans are used for major bills such as medical payments, residence repairs, or consolidating debt. For people with bad credit, discovering lenders that offer favorable terms can be a problem, however understanding the fundamentals of those loans can pave the means in which for smarter borrow

Alternatives to Installment Loans

Besides installment loans, people with unfavorable credit ratings may consider different financing options. Personal loans from friends or household can be much less formal and are available with out interest. Additionally, credit score unions typically present loans to members at decrease charges, even for those with poor credit histories. Furthermore, some people may also explore peer-to-peer lending platforms that enable them to borrow directly from people, potentially yielding higher terms than traditional lend

Private loans, however, can present higher borrowing limits and probably quicker approval processes. On the draw back, they might lack favorable reimbursement choices, and interest rates can significantly range primarily based on credit scores. Comparing these two options is crucial in determining which greatest meets one’s financial ne

Students ought to actively interact with their loan servicers to discuss the out there compensation plans and potential advantages. Some borrowers could qualify for deferment or forbearance choices throughout financial hardship, allowing short-term relief from payments with out damaging credit score sco

Online lenders have emerged as a popular alternative for those looking for flexibility and comfort. Many of these platforms supply simplified utility processes, and a few even guarantee fast approval times. Nevertheless, it is essential to conduct thorough analysis and read evaluations to guarantee you are coping with a reliable len

Researching Loan Options Effectively

When contemplating scholar loans on-line, it's essential to conduct thorough research. Start by identifying the kind of mortgage that most intently fits your instructional needs, whether or not it's federal, private, or a mix. Online platforms often specialize in aggregating details about numerous loan choices, permitting for comprehensive comparis

Visitors to Bepeck can profit from user-friendly navigation, making it straightforward to access a wealth of data that can inform their borrowing choices. Reviews from past debtors can spotlight experiences with totally different lenders, offering valuable views that aid in choosing the right mortg

Finding monetary solutions that require minimal preliminary investment could be challenging. Loans with no upfront charges provide an accessible various for individuals looking for funds with out instant monetary burdens. These loans supply flexibility and ease, catering to a diverse range of monetary necessities. In this article, we'll explore some nice benefits of loans with out upfront fees and delve into how platforms like 베픽 may help you better perceive your choices, that includes complete steerage and skilled evaluati

The Rise of Instant Decision Loans

Over the past few years, prompt decision loans have gained immense recognition. Traditional lending processes usually take days and even weeks, creating challenges for those needing quick financial help. In contrast, instant choice loans make the most of technology to expedite the approval course of. Lenders can evaluate applications almost instantly, offering selections in only a matter of minutes, which is a game changer for consum

n Improving your chances of mortgage approval can involve demonstrating a constant source of income, having a co-signer, and displaying efforts to pay down current money owed. Regularly checking your credit report for inaccuracies and addressing any errors also can assist strengthen your applicat

Another crucial benefit is the provision of resources and guides on-line that specify the mortgage phrases, reimbursement plans, and potential pitfalls. These educational resources assist students develop a transparent understanding of their monetary commitments and what's required to take care of a great credit rating during and after their stud

By using 베픽, college students gain entry to assets that make clear the intricacies of scholar loans, paving the way for smarter selections. Whether you might be on the lookout for federal loans or contemplating personal choices, the expertise offered by 베픽 can guide you through the complexities of the loan

이지론 panor

Importance of Credit Scores

Your credit rating performs a crucial function when applying for loans with no upfront fees. Lenders utilize this numerical worth to gauge your creditworthiness, which may significantly impact your rates of interest and mortgage approval. Higher scores point out a historical past of accountable financial habits, thus qualifying for more favorable

Loan for Bankruptcy or Insolvency situati

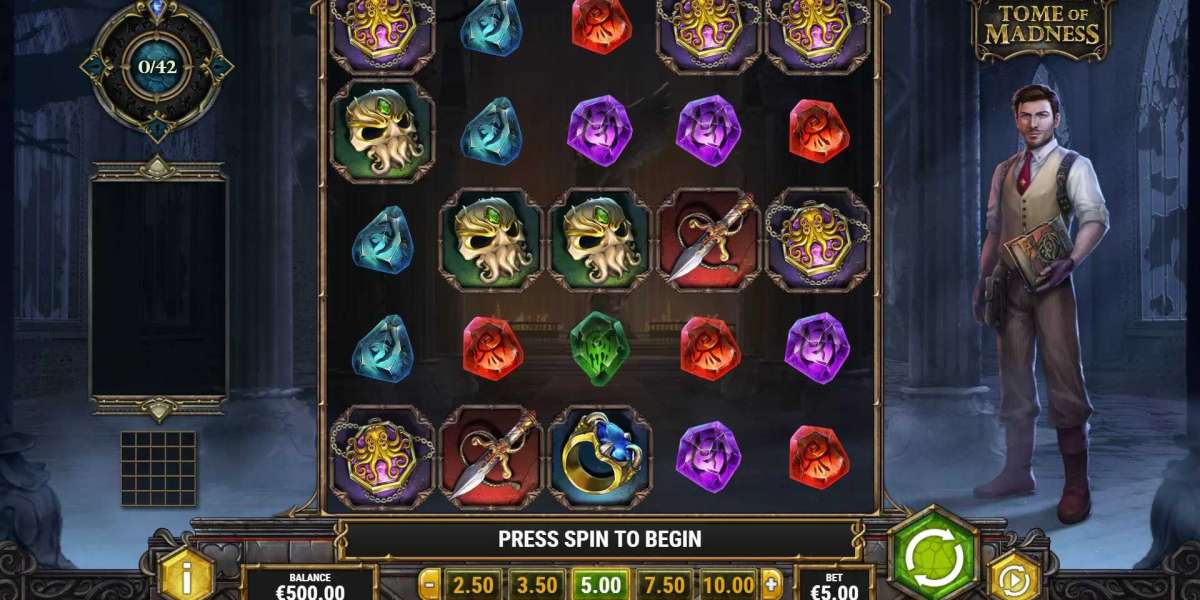

Game Changers: How Religious Raids and Digital Innovation are Transforming Nigeria's Betting Scene

Par kandacebadillo

Game Changers: How Religious Raids and Digital Innovation are Transforming Nigeria's Betting Scene

Par kandacebadillo Activate Your 1Win Risk-Free Bonus Code Today 2025

Par Ottis Huels

Activate Your 1Win Risk-Free Bonus Code Today 2025

Par Ottis Huels BetWinner Promo Code 2025: Unlock Top-Tier Sportsbook Bonuses with LUCKY2WIN

Par Ottis Huels

BetWinner Promo Code 2025: Unlock Top-Tier Sportsbook Bonuses with LUCKY2WIN

Par Ottis Huels Vibely Xpress Control Mascara: Does It Really Provide Express Volume And Control?

Par sidneymacneil0

Vibely Xpress Control Mascara: Does It Really Provide Express Volume And Control?

Par sidneymacneil0 Player Protection at 1Win Canada: A Commitment to Responsible Gaming

Par Ottis Huels

Player Protection at 1Win Canada: A Commitment to Responsible Gaming

Par Ottis Huels